In general, these are my observations of the Tucson market:

Fewer apartment and student housing deals are coming through the pipeline, including new purchases and refinances. We have noticed that lenders have been tightening their restrictions, and most deals are cash, seller-financed, or 1031 exchanges. Cap rates have also started to increase with interest rates. Sellers are still in short supply, and they generally believe we are at or near the top of the market and point out that there are limited options to park their money if they decide to sell. There is a discrepancy between buyer and seller expectations. In the short term, we anticipate fewer deals for the second half 2023. It is important to note that there are currently 3,709 units under construction, 453 pending final approval, and 3,426 units in the planning stages. This will add substantial inventory to the current supply.

However, Tucson does continue to grow and attract new employers, such as American Battery Factory in Tucson, Sion Power in Tucson, Shamrock Foods in Marana, and Amazon in Marana. There is also a need for more new single-family homes in the Tucson area. Potential headwinds include high construction and financing costs. However, the market does adjust and will likely get creative for reducing construction and financing costs, so we expect the market to adapt over the next 12 months. According to Apartment Insights, the vacancy rate in metro Tucson is 8.09%, up 2.32% from last year. Next, I will analyze how Tucson compares to similar cities, Albuquerque and El Paso.

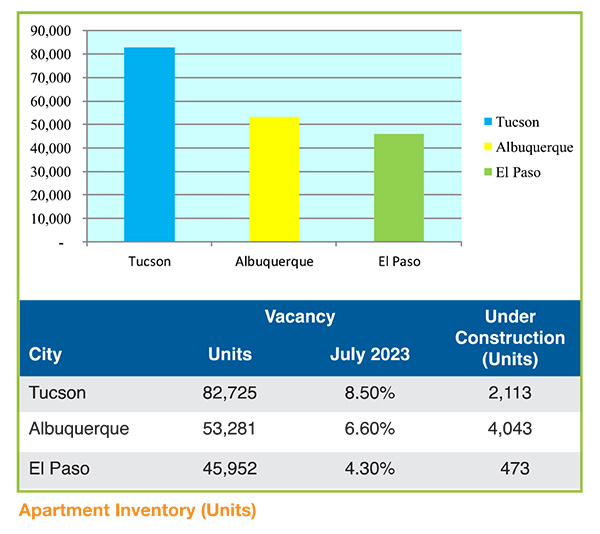

In my recent article, “Tale of 3 Cities-Revisited 8-2023,” I compare the Tucson market to Albuquerque and El Paso. The Tucson market has the most apartment units of the three markets by a large margin. It is noted that the figures in the table and graph below are from CoStar Group, Inc., which differs significantly from Apartment Insights, which is more reliable, but does not cover Albuquerque or El Paso.

For consistency purposes, we analyzed the CoStar figures. Based on the figures in CoStar, Tucson could have the most units of the three markets for several reasons. Several factors can explain this. First, Tucson has the largest university of the three markets and the most extensive metro population of 1.04 million, versus 920K in Albuquerque and 870K in El Paso. Secondly, Tucson has the lowest median household income of the three markets at $48K, versus $56K in Albuquerque and $5lK in El Paso. In the past, higher home prices in Tucson than in the other two markets could have spurred new apartment development to offer a lower-priced housing option, but this is currently not true.

According to Redfin, Tucson’s median home price is about $330K, versus $380K in Albuquerque and $300K in El Paso. In the past, rental rates in Tucson could have been higher than the other two cities, but this is currently not the case either. The average effective rent is $1,203 in Albuquerque, $1,015 in El Paso, and $1,137 in Tucson. Several new units are being constructed in Tucson and Albuquerque. El Paso also has the most significant military base of the three markets, with housing options on the base. This could be why El Paso has the fewest units and the fewest being constructed. Another variable to consider is that Tucson is closer to large Phoenix and California developers than the other two markets, saving time and money for construction and shipping materials.

In summary, we have a long-term positive outlook for multi-family assets in the Tucson market, and they will continue to be 1ighly desirable assets. We anticipate the added inventory to be absorbed quickly, especially given the more considerable housing shortage in the Tucson metro area.

Ajay S. Madhvani, MAI is owner of AM Valuation Services, PLLC in Tucson, Arizona. Ajay has experience throughout the State of Arizona, with primary experience in Southern Arizona and also the Navajo Nation. Ajay is a designated member of the Appraisal Institute (MAI) and is licensed as a Certified General Real Estate Appraiser in the States of Arizona, New Mexico, and Utah. Ajay has experience in apartments, student housing, vacant land, subdivisions, office buildings, retail buildings, service stations, industrial buildings, mobile home parks, self-storage facilities, business site leases, and special use properties. Ajay’s clients include private individuals, corporate organizations, banks, attorneys, and governmema1 agencies. Ajay has experience in preparation of reports for conventional lending, SBA, litigation work, eminent domain work, consultations and appraisal reviews.

Ajay S. Madhvani, MAI is owner of AM Valuation Services, PLLC in Tucson, Arizona. Ajay has experience throughout the State of Arizona, with primary experience in Southern Arizona and also the Navajo Nation. Ajay is a designated member of the Appraisal Institute (MAI) and is licensed as a Certified General Real Estate Appraiser in the States of Arizona, New Mexico, and Utah. Ajay has experience in apartments, student housing, vacant land, subdivisions, office buildings, retail buildings, service stations, industrial buildings, mobile home parks, self-storage facilities, business site leases, and special use properties. Ajay’s clients include private individuals, corporate organizations, banks, attorneys, and governmema1 agencies. Ajay has experience in preparation of reports for conventional lending, SBA, litigation work, eminent domain work, consultations and appraisal reviews.

He can be reached at ajayml999@ gmail.com or 520-441-9030.